As a result of the COVID-19 crisis, the global games market has seen unprecedented engagement levels in the first half of 2020. Video games, always a form of entertainment, have increasingly become a way to cope with not being able to physically see or play with others. The World Health Organization (WHO) suggested video games as a form of social activity during these isolating times. There’s now even a FDA-approved video game prescription called EndeavorRX that can be prescribed to children with attention deficit hyperactivity disorder (ADHD). What was once more of a leisure activity is now vital for some people to manage their lives, especially during lockdown.

Businesses continue tapping into the power of video games. Sony, for example, announced a $250 million investment in Epic Games, the maker behind Fortnite. Sony will take a minority stake in Epic Games, plus it launches Playstation 5 this year, so it’s a strong move for more market gain. Let’s see how Microsoft responds, considering the company is also launching its next-gen console, Xbox Series X, at the end of the year

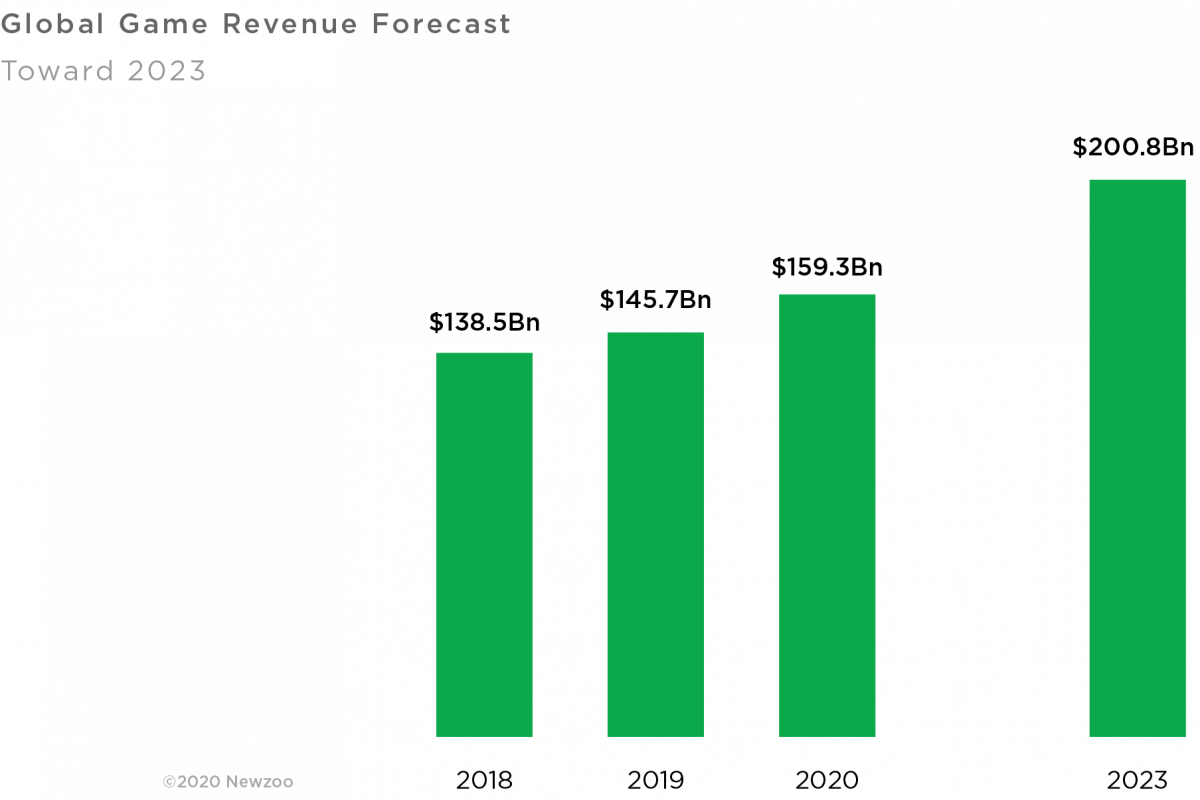

Looking back to 2019, the global games market was expected to generate revenues of $152.1 billion and see a +9.6% year-on-year increase. For 2020, that figure is expected to rise to $159.3 billion, with a +9.3% year-on-year increase, according to Newzoo, a global leading game and esports analytics firm. This increase is driven by the lockdown and launch of next-gen consoles, the report notes.

Newzoo’s findings draw from players, payers and revenues. This year the firm changed the way they calculated things, splitting revenues per platform (PC, mobile, console) and between full games (boxed, digital), plus in-game revenues and then subscription revenues on console.

“We define revenues as the amount the industry generates in consumer spending on games: physical and digital full-game copies, in-game spending and subscription services like PlayStation Plus and Xbox Game Pass. Mobile revenues include paid downloads and in-game spending on all stores, including third-party stores, and from direct downloads,” explains Newzoo.

From February 2020 to March 2020, the firm enlisted over 62,500 invite-only respondents from 30 key countries or markets to be interviewed. These 30 countries/markets together make up more than 90% of global game revenues, according to Newzoo.

They also suggest that over 92 million new players from emerging markets will enter the gaming market in 2020, most entering through mobile, with the number of smartphone users to grow to 3. 5 billion.

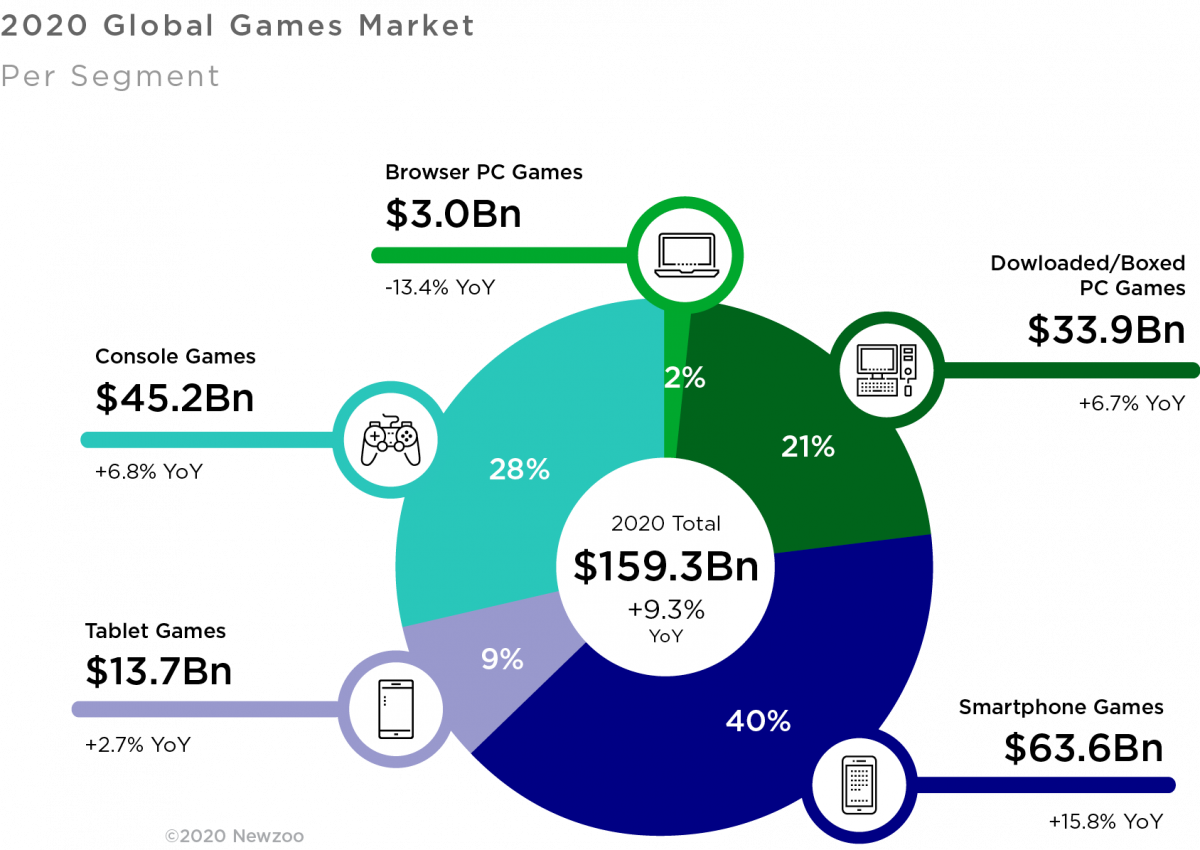

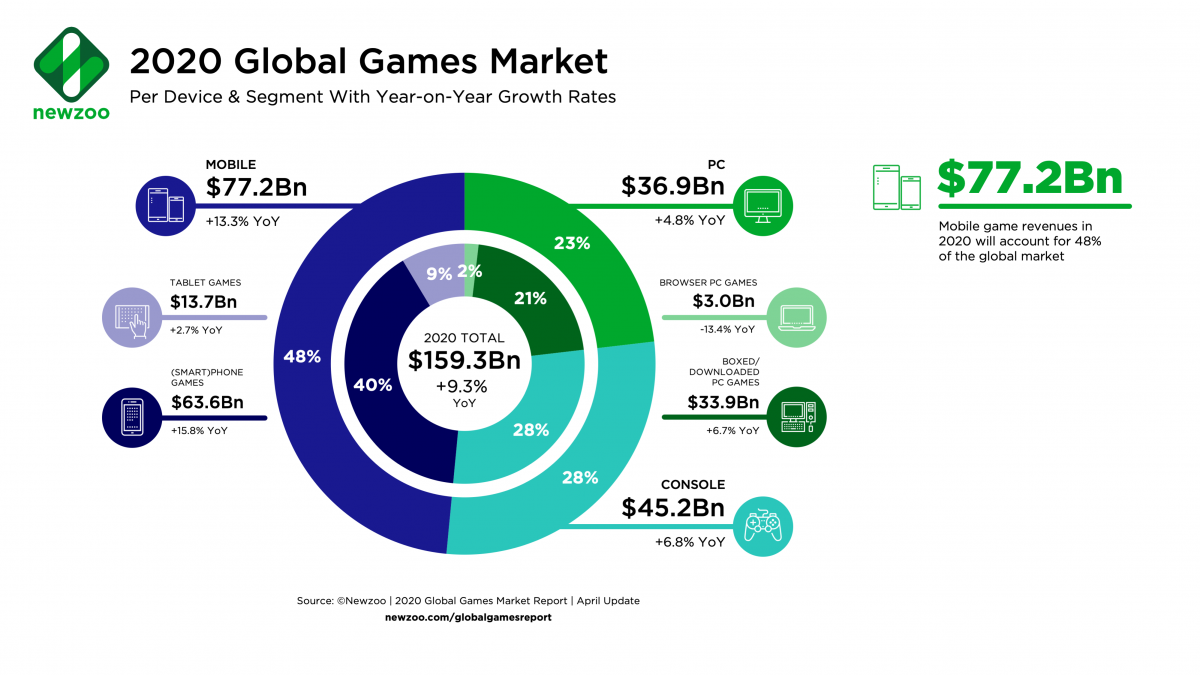

Mobile games (including both smartphone and tablet) remains the biggest segment in 2020, with revenues of $77.2 billion, accounting for 48% of the global games market. Mobile is the largest segment thanks to its low barrier to entry, and now with internet cafes closed, more people are turning to their phones to play games.

The console games segment follows after mobile gaming, growing to $45.2 billion this year. Newzoo reports console growth has slowed down since its peak back in 2018.

In third spot is PC gaming. Newzoo says that PC browser revenues will decline, although PC games are expected to pull in $36.9 billion this year.

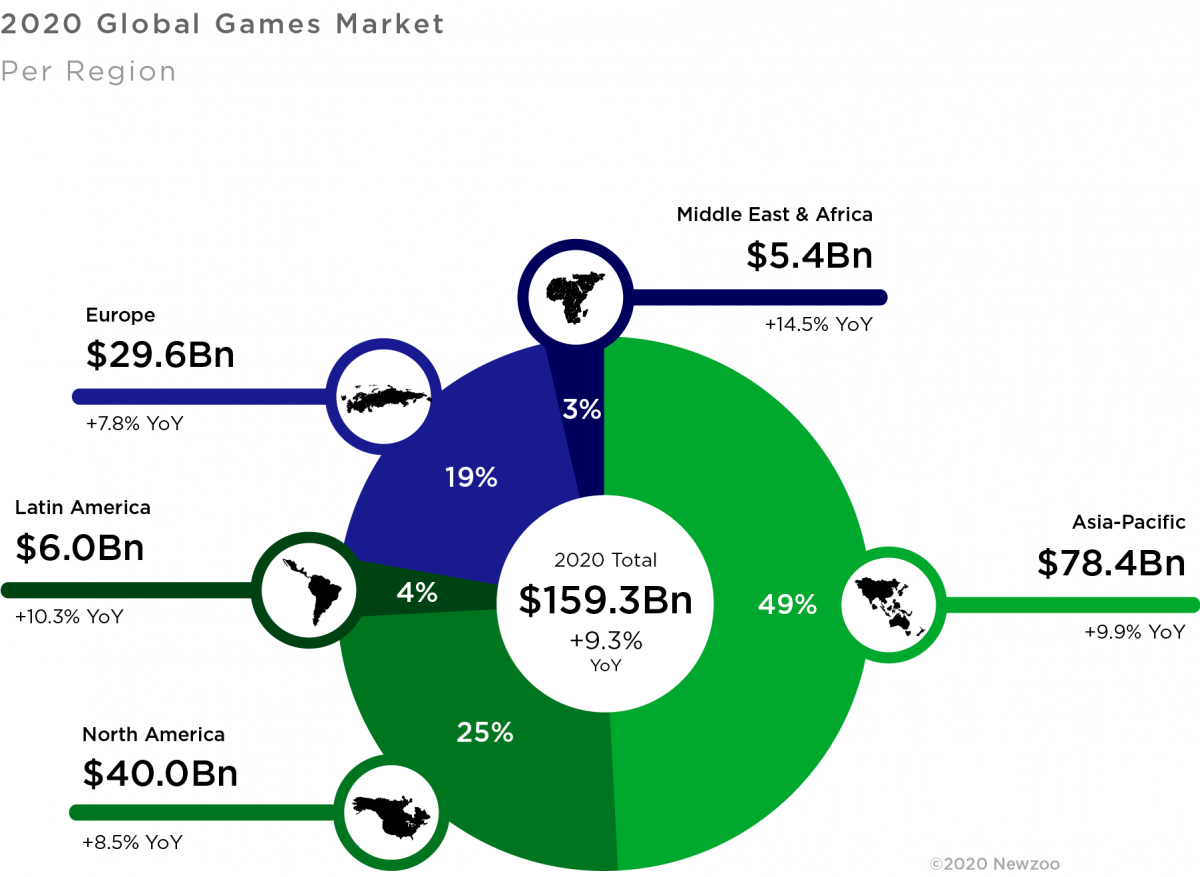

The Asia-Pacific region wields much of the market (it is expected to account for almost half of all global game revenues). In 2020, the Middle East and Africa region will grow the fastest year-on-year, up +14.5% from 2019. But that’s not to say North America, which is the second-largest region by game revenues, has seen little growth, holding 25% of the global games market ($40 billion).

Newzoo predicts the games market will hit over $200 billion in revenue by the end of 2023.

Trending

Keep watch on how cloud gaming evolves, considering Microsoft will launch xCloud in a special bundle with Xbox Game Pass. Sony continues to look at new content partnerships for its cloud gaming subscription service Playstation Now. Google already has its Stadia service in play.

Whether or not people will move to cloud gaming and pay a monthly fee over buying the console upfront will be seen in later months. But Microsoft is betting more on cloud-based givings, hiring for its “Cloud PC” team to initialize the company’s new desktop-as-a-service, Microsoft Cloud PC. It will be built off Windows Virtual Desktop, and Microsoft’s everything bundle (Microsoft 365) will also be part of it.

Cloud gaming is successful because there is no physical hardware or local copy of the game needed to play, making the relatively low cost attractive for users.

Power Players

Chinese studios are recognized for their “prowess in mobile game development,” says Newzoo, noting that

these companies are “establishing development studios for all platforms around the globe.”

The market leads in revenues and by number of players, too.

Chinese company Tencent is a powerhouse because of the company’s ability to sweep up partnerships in overseas markets while keeping a lock on at-home with Chinese users playing popular battle royale games like PUBG Mobile, which now in China is called Game For Peace, a less violent version of PUBG.

To recall, the top 10 public game companies in 2019 that generated the most revenues (from first rank to last) were: Tencent (China), Sony (Japan), Apple (U.S.), Microsoft (U.S.), Google (U.S.), NetEase (China), Activision Blizzard (U.S.), EA (U.S.), Nintendo (Japan) and Bandai Namco Entertainment (Japan).

Esports

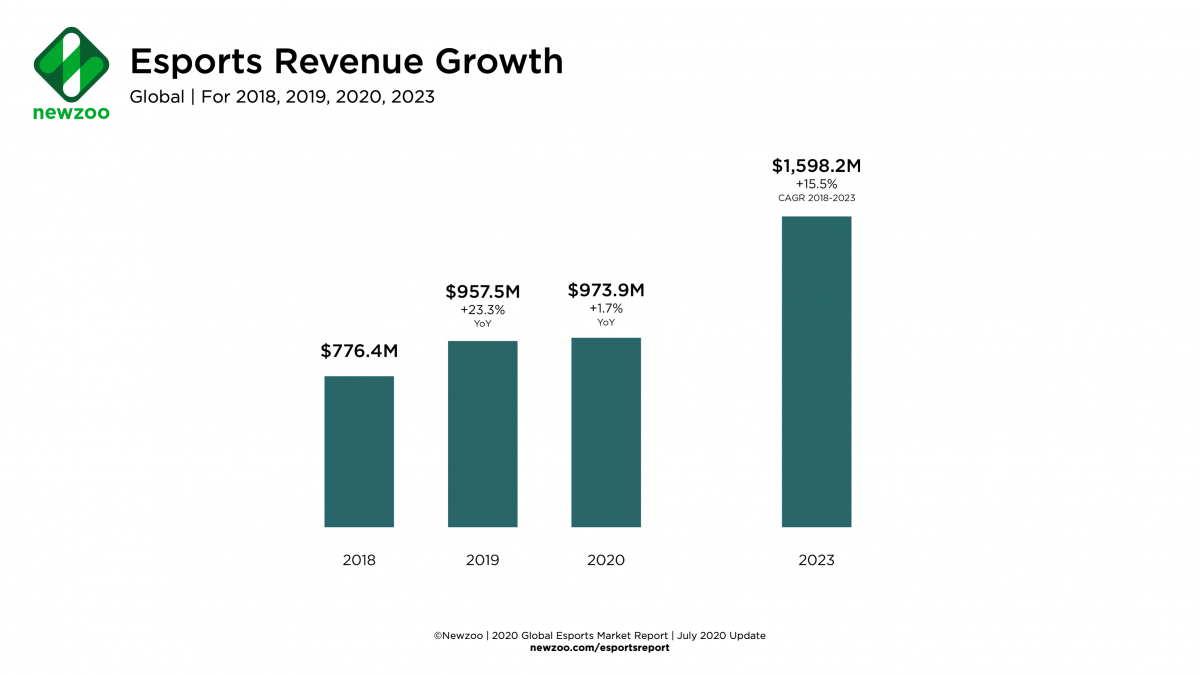

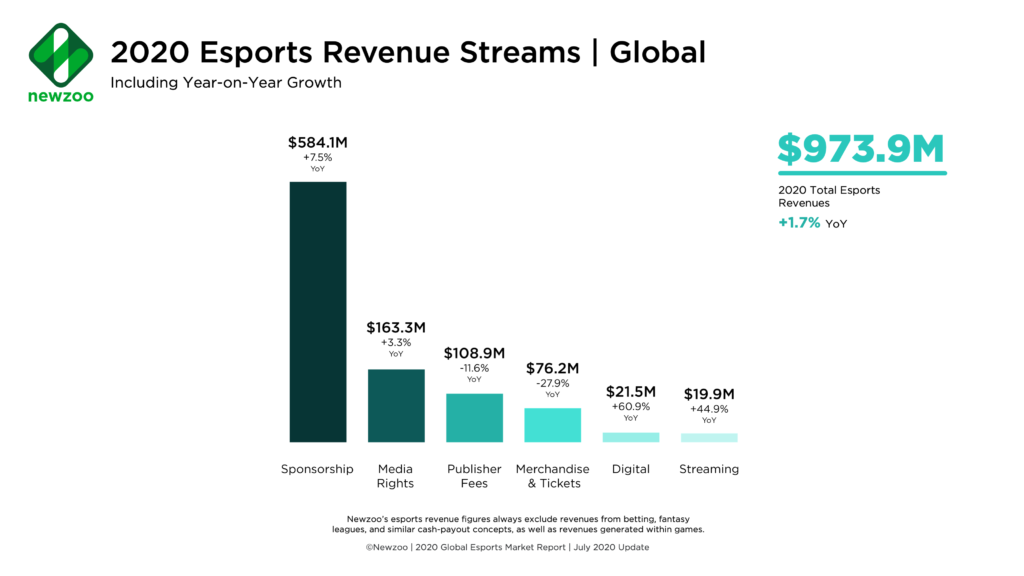

Esports is another part of the games market worth noting. Newzoo reports the global esports industry will generate $973.9 million in 2020 and reach over $1.5 million come 2023.

Like other events, many esports organizations have had to pivot and reschedule tournaments until Q3 or Q4 of 2020, or cancel them altogether. Due to these cancellations, revenue streams have taken a hit—ticketing and merchandising being impacted the most. Media rights and sponsorships continue to operate with a sense of resiliency, reports Newzoo.

To check out last year’s breakdown, which includes more definitions of game personas, head here.

Report, quotes, photos, diagrams provided by Newzoo.